Market Snapshot: April 2021

In summary

The COVID-19 situation around the world is somewhat mixed with India setting new world records for daily new cases and deaths, whilst some of the vaccinated developed countries (e.g. USA, and UK) are showing their lowest numbers in many months.

The vaccination programs are certainly showing excellent results in these early days but India is a reminder of the risks of any complacency.

Bond markets continued to settle down following the February sell-off and this resulted in good returns for bonds, both in Australia and Globally during April. These slightly lower longer term interest rates also aided the often leveraged asset classes, such as Australian Smaller Companies (up 5.0%) and Global REITs (up 6.5%) .

Overall, all risky asset produced strong results during April, including Oil, which all adds up to continued confidence in the vaccines and a move towards potential normal economy.

Looking ahead, the current strong US Fiscal stimulus, continued loose monetary policy from Central Banks around the world, improving outlook for COVID-19 vaccines, and higher economic growth expectations have provided a lot of support for the risky assets over the short term. Of course, the downside risks remain around equity market valuations and there is current preference for Value-styled strategies.

Our portfolios have maintained their neutral position on risky assets and are rebalancing away from cash assets towards higher yielding bonds.

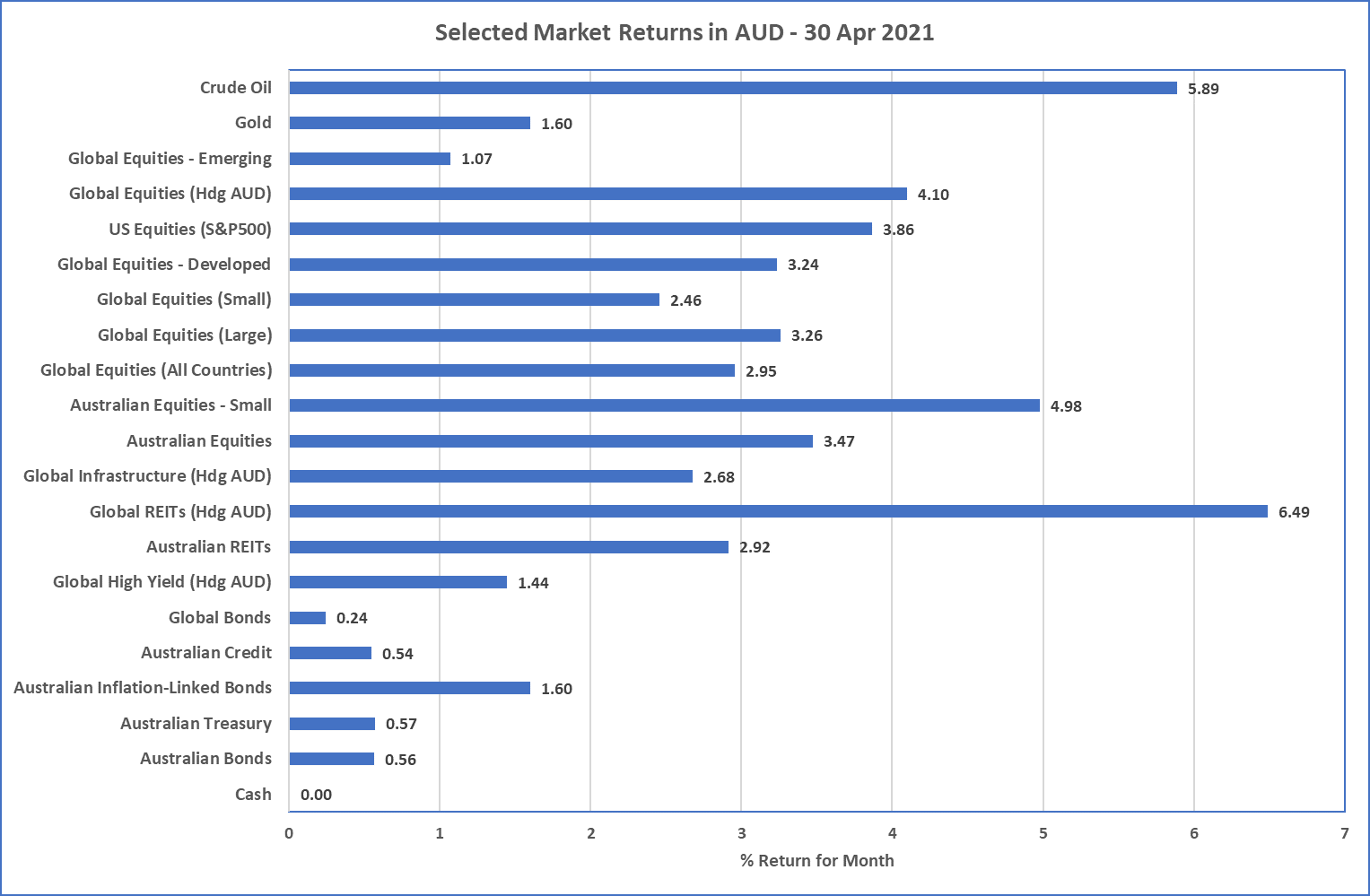

Chart 1: All major asset classes produced positive performance for April

Sources: Morningstar Direct

What happened in April?

Pandemic

India in crisis

- The attention has shifted from developed nations such as USA, and the major countries in Europe to the emerging economies of India and Brazil.

- India’s daily new cases and death rates are current above the worst of the USA and are at world record highs. Their health system is not coping and supplied are being sent from around the world. This second wave occurred after Prime Minister Modi relaxed restrictions back in January whilst suggesting that India was in a good place.

- Complacency around the potential spread and effects of COVID-19 cannot exist and the science must be followed. All countries that have not followed the science of this hideous disease have been the worst example case studies.

- All of that said, the early signs of vaccination success appears good and these vaccines must be worldwide, including the poorer nations.

- There is current talk about the removal of patents on the major vaccines to enable their reproduction for the betterment of humankind over corporate profits.

Markets

Nothing but positive

- All major asset classes produced positive returns in Australian Dollar terms for April 2020 with the best performers being Global REITs and Crude Oil (refer chart on previous page).

- Their strong performance is suggestion the global economy is looking strong for 2021 and this is also supported with increases from various economic institutions. The IMF forecast global economic growth of over 6% in 2021.

- Bond markets were relatively steady in April with relatively small changes around the world. The primary global benchmark, Bloomberg Barclays Global Aggregate (Hdg AUD) returned a relatively low 0.24% whilst the Australian benchmark, Ausbond Composite, returned 0.56%.

- Global equities returned around 3.2% for April and this was primary driven by the US (S&P500 up 5.2% in USD).

- A final statistic that augurs well for the outlook of the economy and the calm of equity markets is the reduction in the VIX (or Fear) index. It is down to ~19 which is half of where it was at just 6 months ago.

Geopolitics

It verbal between China and everyone

- The global focus continues to the recovery from the pandemic and little other Geopolitical issue appears to have been important. The on exception being Australia and USA’s stronger rhetoric against China (and vice versa) and their intention to control their increasing large share of the world economy.

- At this stage the relationship between China, Australia and USA is challenged but, as mentioned, the current behaviour is largely verbal and there has been no economic or military action to affect markets.

Outlook

As mentioned last month, the economic outlook for the world and its biggest economy, USA, is very strong. This has been supported by markets which have supported growth assets whilst longer term bond yields have sustained their February yield increases.

The vaccination success in UK and USA is very encouraging but the economic potential of the world will still be larger than usual for a year or two yet. Wider and more accessible vaccination rollouts must be completely global and not just for rich nations. Increased production and broad cooperation is required for a normal economy to exist again.

From a portfolio perspective, the position is unchanged… the slightly higher bond yields have resulted in a preferred shift away from low interest rate cash and towards bonds. Given high equity market valuations, there has been little incentive to increase allocations towards these risky assets and maintaining a neutral position between risky and not-risky assets is preferred for now (although higher equity market volatility would be unsurprising).

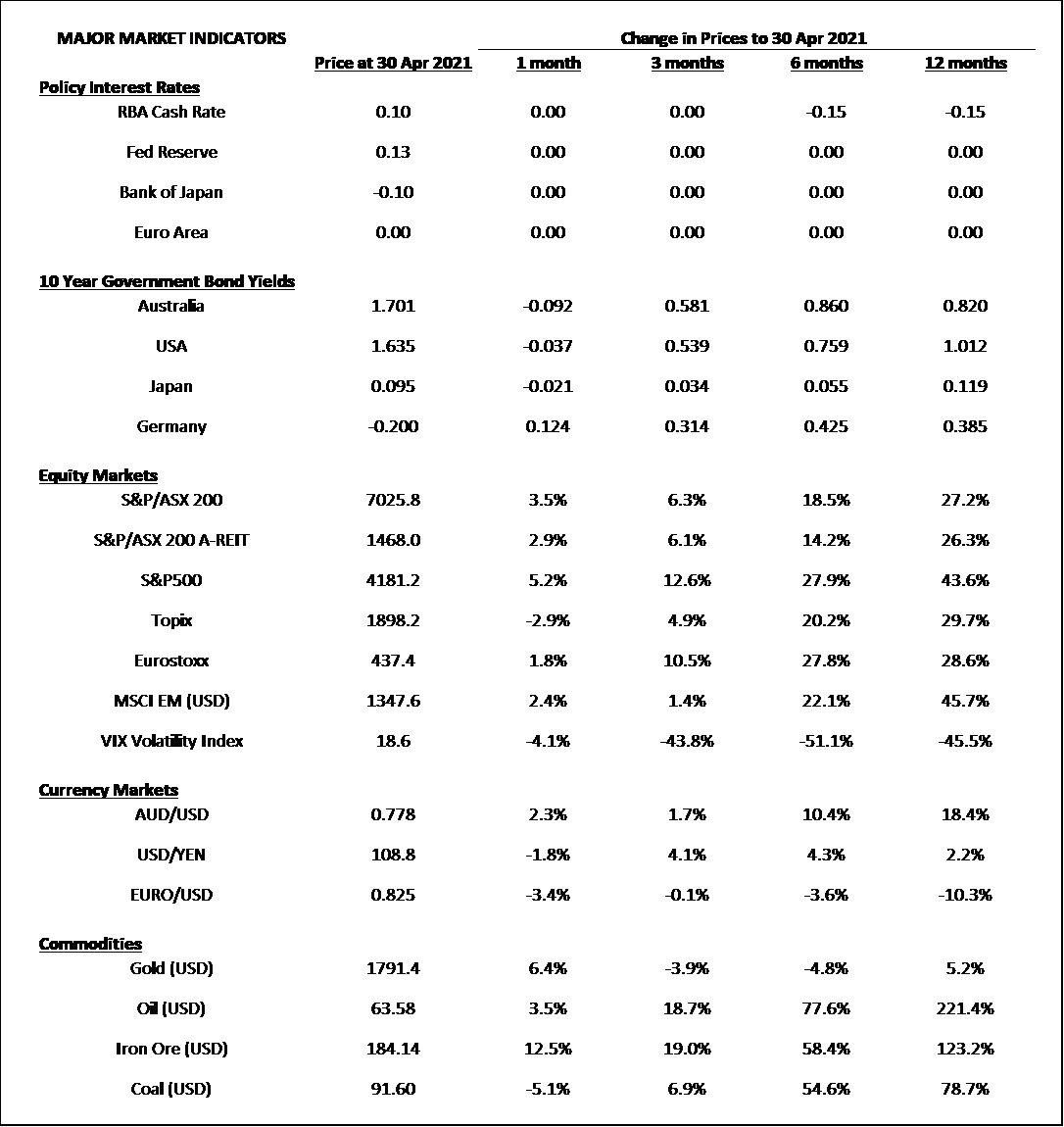

Major Market Indicators

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619