Market Snapshot: May 2022

In summary

-

The month of May is a near replication of April 2022.

- High inflation persisted around the world (even Japan's was high-ish)

- Central Banks increased cash rates ... including RBA increasing to 0.85%

- Equity and Bonds market benchmarks declined

- Equity prices increased ... as did food ... primarily because of the Russian / Ukraine War

- The outlook is for continued market volatility and particularly amongst equity and credit markets, as they are most vulnerable to rising cash rates.

- Taking another step further is the more expensive growth markets (including US Growth, and Tech) are likely to come under further pressure as their valuations continue above long term trend levels.

-

Our current preference for portfolio positioning is to avoid concentrated bets (i.e. maintain diversification), rebalance, and for

equity allocations we believe a bias towards cheaper (i.e. Value) securities is preferred. That said, care must be taken to ensure the

cheaper securities don’t have balance sheets vulnerable to rate increases, so a Quality bias is also preferred.

- After many years in the investment wilderness, it appears the Value / Quality investment style of Warren Buffett (Age 91) may be back ... if only the youth will listen!

Chart 1: Another difficult month in traditional asset classes

Sources: Morningstar

What happened in May?

Pandemic

Holding back China

- Whilst most of the world has put its faith in masks, vaccines, with a current less virulent strain, China continues its zero-COVID policy much to its economic detriment and the rest of the world’s as orders for Chinese manufactured goods are slow to deliver.

- COVID won’t disappear, has changed the way we all live, so will lurk in the background as a risk whilst there exists the chance of another strain being more contagious, vaccine-resistant, and deadly. Continue to watch this space.

Markets

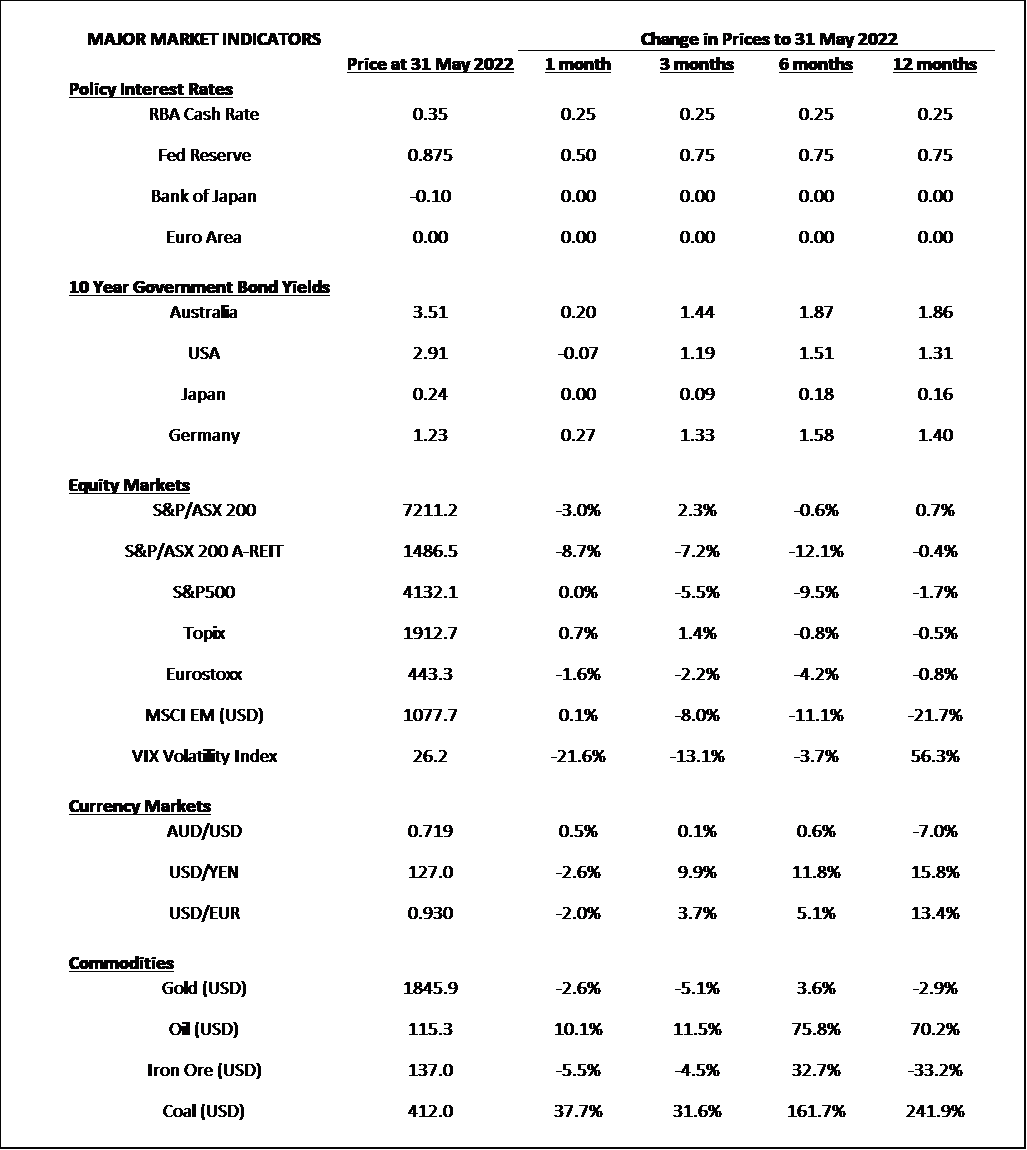

Looks like April

- Except for energy commodities (Oil and Coal), most equity and bond markets declined again in May. The worst performance came from REITs, where Australian REITs declined by almost 9% and Global REITs by almost 5%. Contrasting REITs was the positive return of the other listed “real” asset, Global Infrastructure, at just over 2% for the month.

- The main catalyst for the declining returns was the continued high inflation numbers and increasing cash rates. At the time of writing (7 June), the Reserve Bank of Australia has just increased its cash rate by another 50bps after 25bps in May, to leave its headline cash rate at the still low level of 0.85%. Nevertheless, this is unlikely to be the last rate rise as inflation rose faster than the RBA expected, and they expect it to stay high for the remainder of 2022.

-

What is unusual is the much higher 10-year bond yield in Australia compared to the rest of the world. Australia’s inflation is not as high,

nor is wage inflation, but at over 3.5% this is a 0.50% premium to the US 10-year bond yield.

- This is a potential hint that the Australian bond market may be a little oversold, compared to USA, and returns for Australian bonds may start to settle compared to the previous volatile 6 months.

Economy

Inflation Everywhere

- Headline inflation in USA is above 8%, so too Europe, Australia’s is over 5%, and all nations/regions are experiencing relatively low unemployment compared to the last 10+ years. Now, for the first time since 2015, Japan has experienced inflation above 2% and is currently 2.5%!

- This all adds up to higher cash rates everywhere with the main questions being … how far? How fast? And will it create recession? We don’t fully know the answers to these questions, but we expect equity and credit markets to maintain their higher volatility no matter what.

- For Europe, the Russian/Ukraine war has created some economic challenges as they try to remove their reliance on Russian energy supplies...no easy task. For the world, it looks like this war has also increased food prices which will impact those most vulnerable. This war is a critical contributor to the current global inflation and economic position, and the biggest concern is there appears no obvious end or way out. So with this in mind, it simply adds to the thesis that market volatility is the obvious outcome.

Outlook

- It appears along with inflation, 2022 will likely be seen as a very volatile year for all markets.

-

The higher bond yields are resulting in large shifts across equity markets as expensive securities are sold off and the previous momentum

of growth, tech, and ESG-friendly themes are replaced by lower valued, lower growth (some may call) boring securities.

- Valuations remain high in USA and still carry downside risks. Whilst Emerging Markets’ valuations continue their appeal, they carry a unique set of risks in the form of China with their continued COVID lockdowns and potential government crackdowns on markets.

- With many bonds, both high and low risk, providing yields well above inflation, it is possible the worst is behind us. Whilst it is sometimes difficult to take the contrarian view, rebalancing portfolios appears to be prudent if taking a long-term view.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL

491619