Market Snapshot: September 2021

In summary

- Australian vaccination levels are increasing sharply suggesting a faster than expected opening of the economy which may result in strong economic output for 2022 (despite the negative result coming for the September quarter).

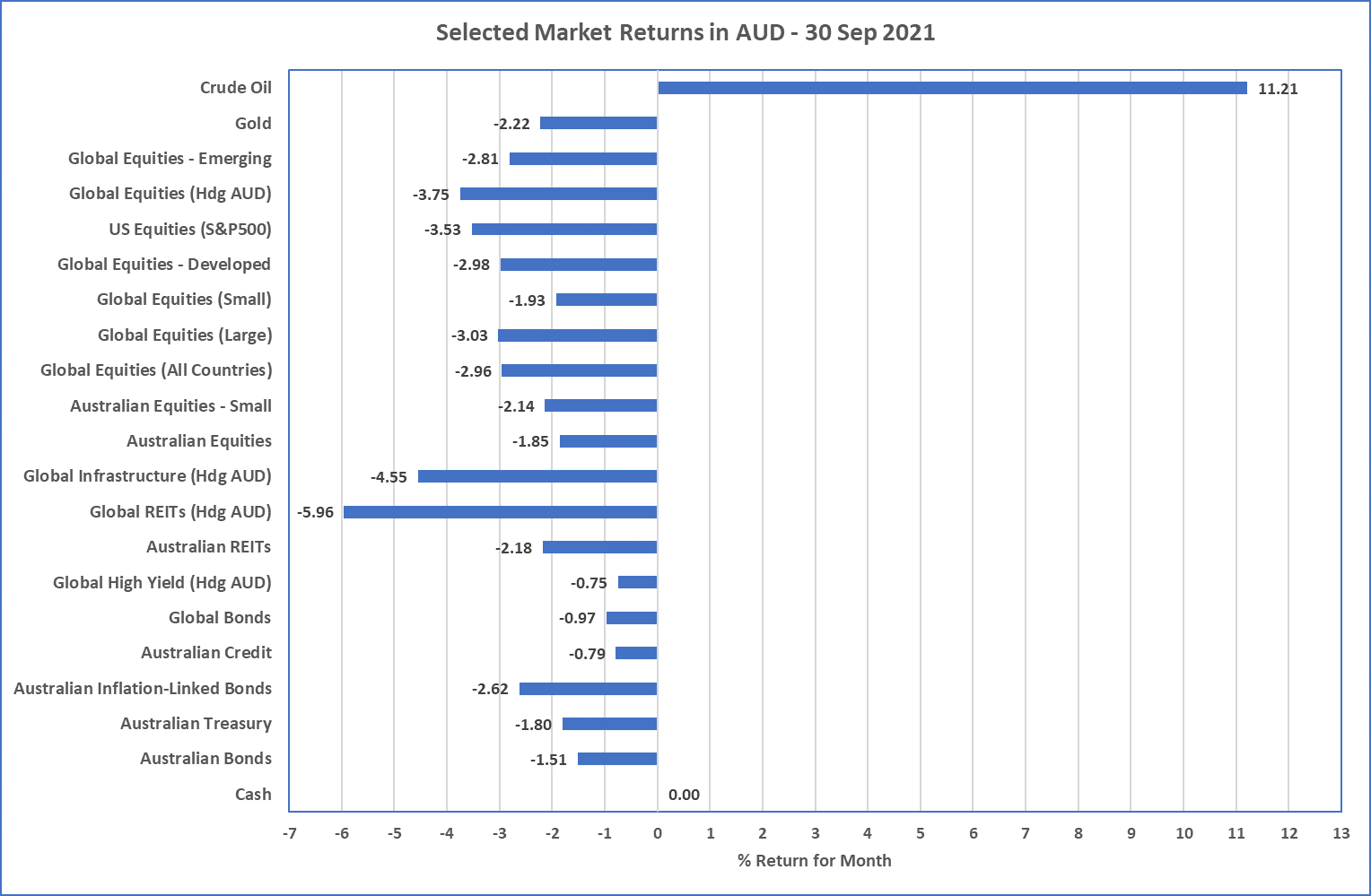

- September saw a pause or slight decline for virtually every asset riskier than Cash (see Chart 1). Strangely this is not unusual for the month of September and it is too early to tell whether this downturn will be sustained, but high equity market valuations (particularly in the USA) increase this possibility.

- Economically, inflation is all that matters. Whilst it’s been relatively high around the world in recent months it has come from a low base and there are mixed signals, including supply chain problems, suggesting higher inflation could continue. Despite this, bond markets are currently priced with the expectation that inflation will revert to its pre-COVID low(ish) levels.

- Our investment strategy is unchanged. It continues its focus on diversification avoiding concentrated risks/bets. Whilst Cash and Bonds continue to have low expected returns, we carry small investment grade quality credit allocations to boost these returns and our concerns around equity valuations are tempered with defensive-like equity strategies.

Chart 1: Negative returns everywhere … who knew?

Sources: Morningstar Direct

What happened in September?

Pandemic

Australia’s continued lockdown guarantees a declining economy … but vaccination skyrockets

-

Given Sydney and Melbourne have been locked down for almost the whole of the September quarter, the September quarter is virtually

guaranteed to be a negative result for Australian economic growth. Despite that, vaccination levels have skyrocketed and at the time of

writing more than 81% of people aged over 16 have received their first dose and almost 60% have had their second dose.

- This augurs well for a fast economic recovery and speedier opening of the broader Australian economy than previously expected.

-

Globally, vaccination rates have been mixed and the Delta variant appears to have been rampant amongst the unvaccinated keeping case numbers

high and health systems on edge. Either way, vaccination is the only solution for now and 2022 is still looking like a potential return to

global normality.

- The major risk factor is and will be the appearance of a more deadly variant … so far so good.

Markets

Momentum stalled

- Chart 1 tells a fairly obvious story for September … essentially every asset class riskier than Cash producing negative returns. These returns are mostly around 2% to 3% down and is due to a combination of factors but at the end of the day, September saw bond yields increase (therefore declining bond prices) which also feed into a slight valuation adjustment downwards for risky assets.

- The exceptions to the price declines were the energy commodities which include Oil and Coal which continued their momentum as the global economic recovery continues but supply chain problems peak due to global travel restrictions and associated bottlenecks.

- For now, asset prices appear to be a pause but the high valuation theme continues and downside risks from current levels are still high. Exceptions include Emerging Markets, Europe and Japan whilst USA markets continue to be near record highs.

Economies

Inflation is the focus

-

The data statistic that is creating most interest is inflation. Higher economic growth is largely expected, but inflation will determine the

direction of interest rates and therefore potential valuation adjustments for equity markets.

- For now, markets appear to side with Central banks who have the belief that high inflation is likely to be shorter term in nature and unlikely to be sustained. This suggests interest rates are likely to be contained and shift slowly. Spikes in interest rates or bond yields may occur if high inflation looks sustainable and this would also likely create volatile equity markets.

Outlook

- Markets are in the middle of a shift or pause in positive momentum and the recent high returns of the last 12 months appear unlikely when looking forward.

- We are maintaining strong levels of diversification in portfolios as the major risk mitigator, and equity strategies and bond holdings continue as defensive hedges to potential market volatility.

Major Market Indicators

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619